-

City Services

-

Column 1

- Bids, RFPs, & RFQs

- City Code

- Forms & Permits

- Start a Business

- Contracts

- Economic Development

- Project Management Dashboard

Column 2

- City Council

- Council Goals

- City Fees

- Agendas & Minutes

- Ordinances

- Resolutions

- Public Records

- Projects & Land Use

Column 3

- Departments

- Executive

- Community & Economic Development

- Finance

- Human Resources

- Library

- Municipal Court

- Police

- Public Works

Column 4

-

-

Departments

-

Column 1

Column 2

- DEPARTMENTS

- Executive

- Community and Economic Development

- Library

Column 3

-

-

Community

-

Column 1

- About

- History

- Sweet Home Today

- Email Subscriptions

- Events and Activities

- Art Show in City Hall

- City Calendar

- Community Events

- Downtown Flags

- Sweet Home Farmers' Market

Column 2

- Chamber of Commerce

- Chamber Calendar

- Health Services

- Landlord/Tenant Resources

- Library

- Library Events

- Managed Outreach & Community Resource Facility

Column 3

- Public Safety

- Sweet Home Police Department

- Sweet Home Fire & Ambulance District

- Recreation

- Community Pool

- Parks and Recreation

- City Parks and Trails Directory

- Recreation Programs

Column 4

-

-

How Do I?

-

Column 1

- Apply for a Job

- Apply for a Passport

- Apply for a Special Event Permit

- Watch a Live-stream

- Contact the City

- Submit a Request or Concern

- View Staff Directory

Column 2

- Documents & Forms

- View Documents & Reports

- Adopted Budget

- View Forms & Applications

- File a claim against the City

- Events & Meetings

- View Agendas & Minutes

- View Calendar

- Email Subscriptions

- View Press Releases

Column 3

- Report Storm Related Issues

- Report Streetlight Problem

- Report Water Main Breaks

- Volunteer

- View the Budget

Column 4

-

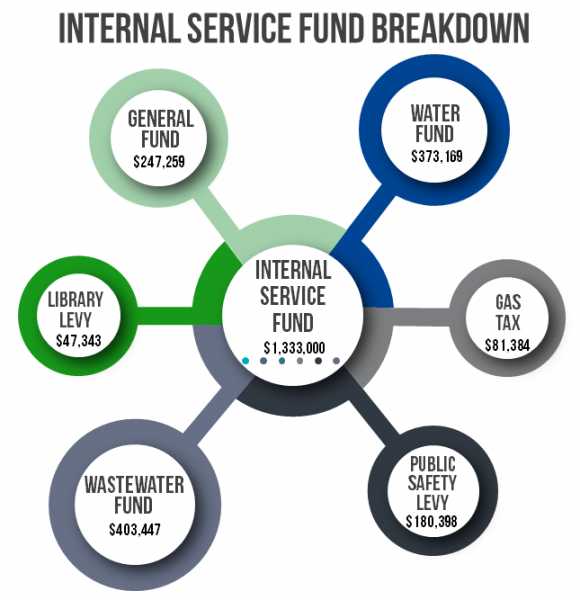

Internal Services Fund

The establishment of an Internal Service Fund is recognized practice done by many local municipalities including Corvallis, Silverton, Albany, Stayton, Monmouth, Bend and many others. The State of Oregon sets parameters for the creation and usage of the Internal Service Fund HERE.

As an Oregon municipality we are bound by the totality of the Oregon Revised Statues and the Oregon Administrative Rules regarding the Internal Service Fund.

What is an Internal Service Fund?

Internal services are those responsibilities a government provides to support its own internal operations.

Here is how the Oregon Administrative Rules defines Internal Service Funds — To account for the financing of goods or services provided by one department or agency to other departments or agencies of the governmental unit, or to other governmental units, on a cost-reimbursement basis.

Common examples of internal service include information technology, payroll, motor pool, budgeting, legal, accounting, and human resources.

Each of the following funds pay into the Internal Service Fund:

- General Fund

- Water Fund

- Gas Tax

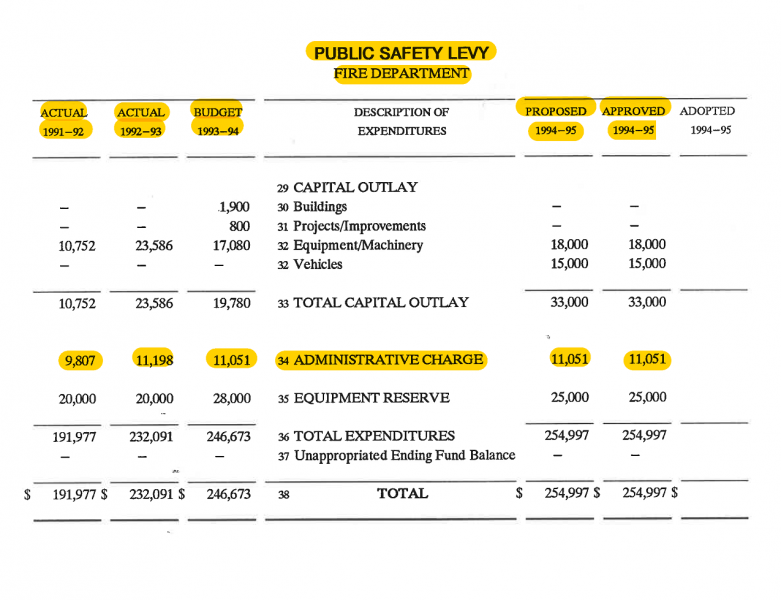

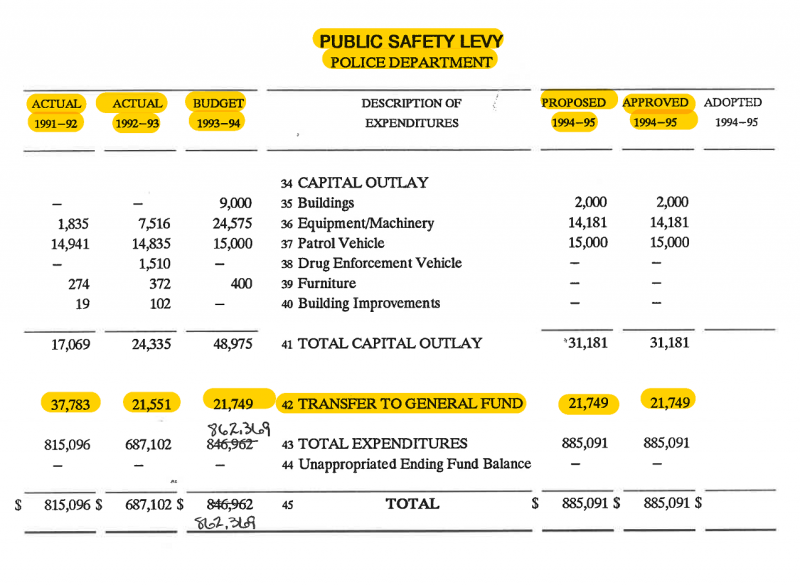

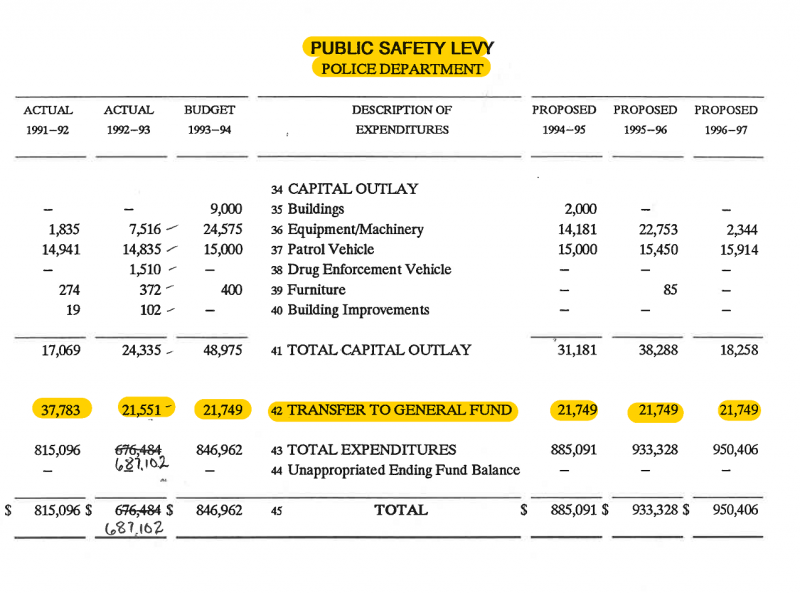

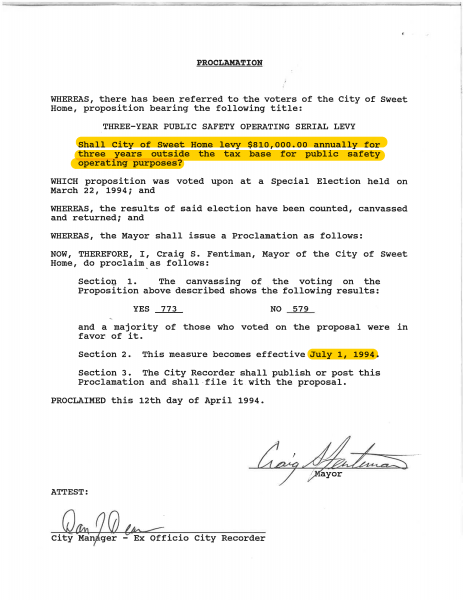

- Public Safety Levy

- Wastewater Fund

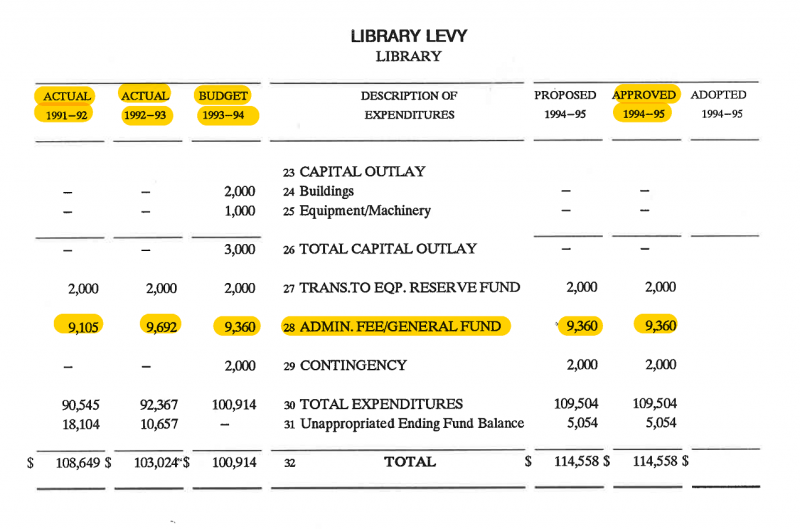

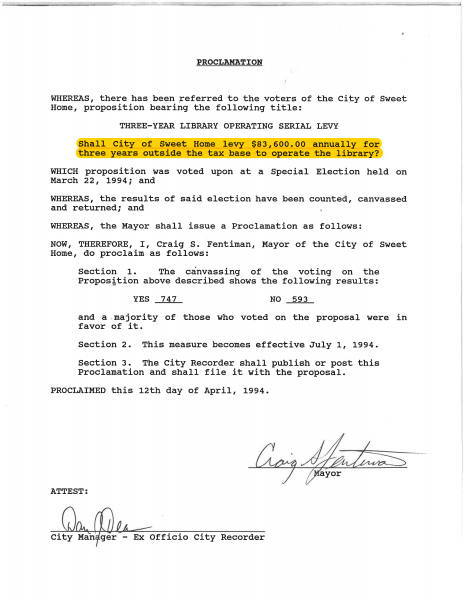

- Library Levy Fund

Calculation Method Used:

•Costs based on Human Resource functions - Costs are split based on department personnel as percent of total City staff.

Example: Library has 4 employees. The City has a total of 54 employees. 4 Employees divided by 54 Employees = 7.41%

- Expenses figured by this method:

- City Manager’s Office

•Costs based on Expenditures - Costs are split based on a department's total expenses as percent of the City's total expenses.

Example: Public Works total expenses are $10,956,168. The City's total expenses are $17,287,783. $10,956,168 divided by $17,287,783 = 63.38%

- Expenses figured by this method:

- City Attorney

- Communications

- City Audit

- Contingency (required by City Policy)

- Utility Billing (Water/Wastewater ONLY)

- Public Works Admin Staff (PW Divisions ONLY)

•Costs based on other methods

- Website

- Equally split across all departments: $3,255.00 = $814.00 per department/year.

- Ordinances

- Equally split across all departments: $5,000.00 = $1,250.00 per department/year.

- Finance Department

- Payroll

- Calculated by actual check volume & cost to produce checks: $81.84 (bank expenses, computers, personnel time, software, utilities, and other de minimis costs)

- Example: General Fund = (10 paid employees x 12 months) x $81.84 = $9,820.80

- Calculated by actual check volume & cost to produce checks: $81.84 (bank expenses, computers, personnel time, software, utilities, and other de minimis costs)

- Accounts Payable

- Calculated by actual check volume & cost to produce checks: $81.84 (bank expenses, computers, personnel time, software, utilities, and other de minimis costs)

- Example: Police Department - 569 checks in 2018 x $81.84 = $46,566.96

- Calculated by actual check volume & cost to produce checks: $81.84 (bank expenses, computers, personnel time, software, utilities, and other de minimis costs)

- Payroll

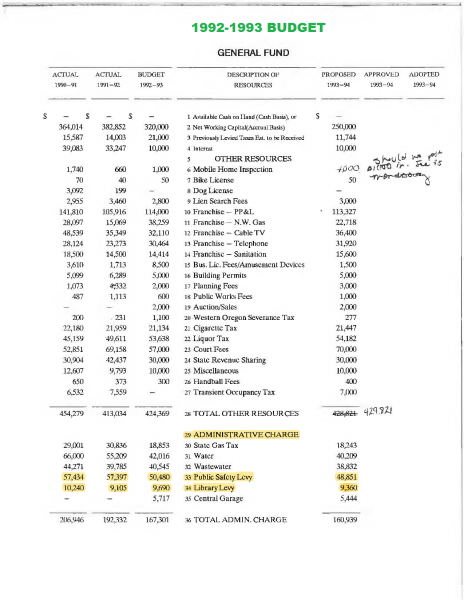

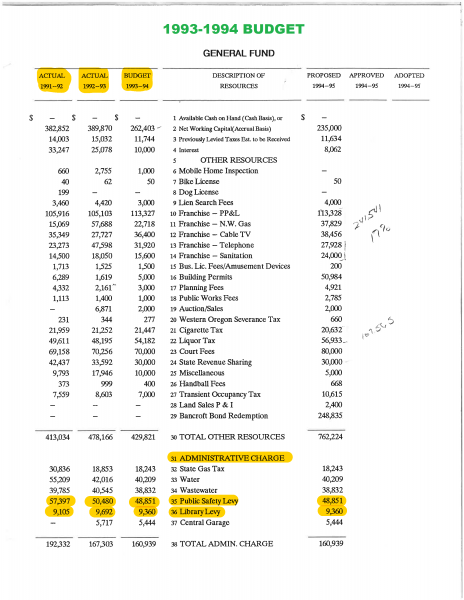

The City of Sweet Home has a documented history of the special levies & other funds paying for their administrative support.